Read 7+ pages when there is a change in estimated depreciation answer in Doc format. C only future years depreciation should be revised. If there is a significant change in an assets estimated salvage value andor the assets estimated useful life the change in the estimate will result in a new amount of depreciation expense in the current accounting year and in the remaining years of the assets useful life. 11Changes in the useful life of depreciable assets. Check also: when and when there is a change in estimated depreciation A previous depreciation should be corrected.

Therefore the revalued amount of asset will be the carrying amount of asset and residual value will be deducted from the same to compute depreciable amount which is to be reduced over the remaining useful life of asset. 25Current and future years depreciation should be revised.

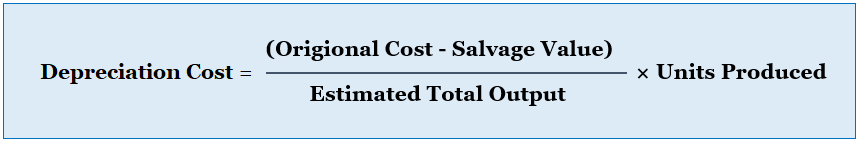

Depreciation Formula Calculate Depreciation Expense From the date of revision until the end of useful life of asset.

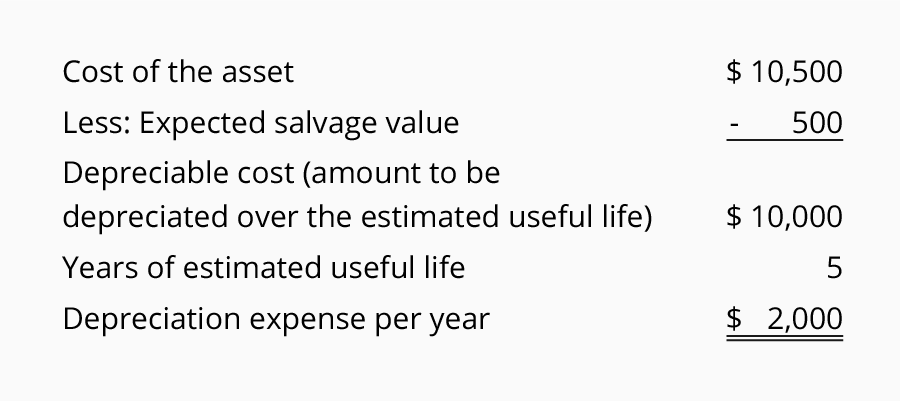

| Topic: Depreciation Expense Cost Salvage value Useful life. Depreciation Formula Calculate Depreciation Expense When There Is A Change In Estimated Depreciation |

| Content: Learning Guide |

| File Format: DOC |

| File size: 725kb |

| Number of Pages: 21+ pages |

| Publication Date: October 2017 |

| Open Depreciation Formula Calculate Depreciation Expense |

|

Take an asset that has a value of 50000.

In straight-line depreciation the expense amount is the same every year over the useful life of the asset. Each year the book value changes because some of the value has already been depreciated. When there is a change in estimated depreciation. New plant assets should be acquired to replace the old. B current and future years depreciation should be revised. Depreciation Formula for the Straight Line Method.

Change In Accounting Estimate Examples Internal Controls Disclosure When there is a significant change in the pattern of the future economic benefits from the asset then the method of depreciation should also be changed.

| Topic: Current and future years depreciation should be revised. Change In Accounting Estimate Examples Internal Controls Disclosure When There Is A Change In Estimated Depreciation |

| Content: Learning Guide |

| File Format: DOC |

| File size: 1.6mb |

| Number of Pages: 45+ pages |

| Publication Date: August 2019 |

| Open Change In Accounting Estimate Examples Internal Controls Disclosure |

|

Units Of Production Depreciation How To Calculate Formula 18When there is an indication that a change in depreciation method salvage value or estimated useful life is necessary then the business should revise its depreciation estimates accordingly.

| Topic: Depreciation expense for the machine would therefore be as follows. Units Of Production Depreciation How To Calculate Formula When There Is A Change In Estimated Depreciation |

| Content: Answer |

| File Format: PDF |

| File size: 3.4mb |

| Number of Pages: 26+ pages |

| Publication Date: September 2019 |

| Open Units Of Production Depreciation How To Calculate Formula |

|

The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business The useful life is 20 years and the salvage value is 1000 so the depreciation for each year is 2450 50000 - 1000 divided by 20.

| Topic: A previous depreciation should be corrected. The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business When There Is A Change In Estimated Depreciation |

| Content: Summary |

| File Format: DOC |

| File size: 725kb |

| Number of Pages: 27+ pages |

| Publication Date: February 2018 |

| Open The Small Business Accounting Checklist Infographic Small Business Accounting Small Business Finance Bookkeeg Business |

|

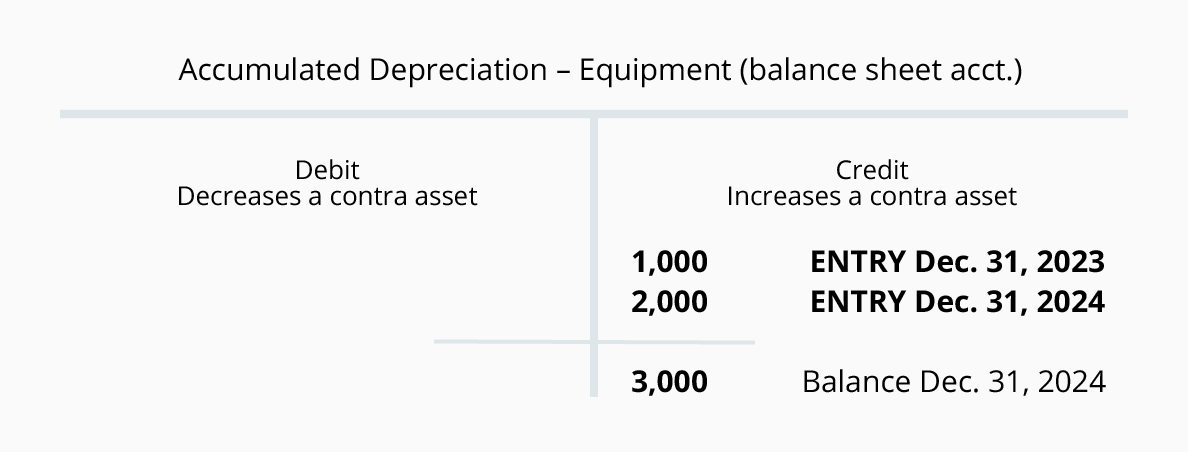

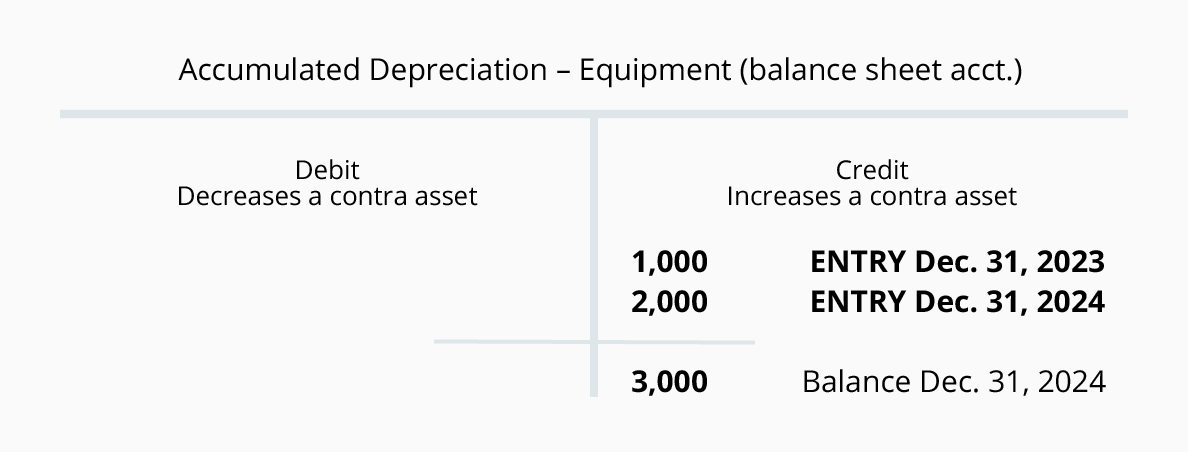

Straight Line Depreciation Accountingcoach 22The book value of an asset is how its shown on the business balance sheet.

| Topic: B current and future years depreciation should be revised. Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Content: Solution |

| File Format: PDF |

| File size: 2.1mb |

| Number of Pages: 26+ pages |

| Publication Date: July 2021 |

| Open Straight Line Depreciation Accountingcoach |

|

Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset 5Now the requirement from Business is that they have wrongly mentioned the useful life as 1 but actually it should be 2 years and when we change the useful life there shouldnt be any change in already posted depreciation values ie.

| Topic: The depreciation amount only changed from period 4 to 50 from 100 as the useful life will be 2 years. Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset When There Is A Change In Estimated Depreciation |

| Content: Summary |

| File Format: Google Sheet |

| File size: 1.4mb |

| Number of Pages: 9+ pages |

| Publication Date: March 2017 |

| Open Fixed Assets Depreciation Read Full Article Read Full Info Accounts4tutorials 2015 10 Fix Accounting And Finance Asset Management Fixed Asset |

|

Small Business Accounting Checklist An Immersive Guide Abhishek Sawant Changes in the amount of expected warranty obligations.

| Topic: When there is a change in estimate account for it in the period of change. Small Business Accounting Checklist An Immersive Guide Abhishek Sawant When There Is A Change In Estimated Depreciation |

| Content: Analysis |

| File Format: PDF |

| File size: 1.6mb |

| Number of Pages: 45+ pages |

| Publication Date: June 2019 |

| Open Small Business Accounting Checklist An Immersive Guide Abhishek Sawant |

|

Straight Line Depreciation Accountingcoach Suppose for example a business originally purchased an asset for 120000 and at the time decided to use the straight line method of.

| Topic: Aug 08 2021 Answer. Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Content: Solution |

| File Format: PDF |

| File size: 2.3mb |

| Number of Pages: 5+ pages |

| Publication Date: June 2017 |

| Open Straight Line Depreciation Accountingcoach |

|

Depreciation Methods Principlesofaccounting D None of the above.

| Topic: When a change in the useful life estimate occurs there is no need to make a journal entry. Depreciation Methods Principlesofaccounting When There Is A Change In Estimated Depreciation |

| Content: Analysis |

| File Format: DOC |

| File size: 2.2mb |

| Number of Pages: 29+ pages |

| Publication Date: December 2020 |

| Open Depreciation Methods Principlesofaccounting |

|

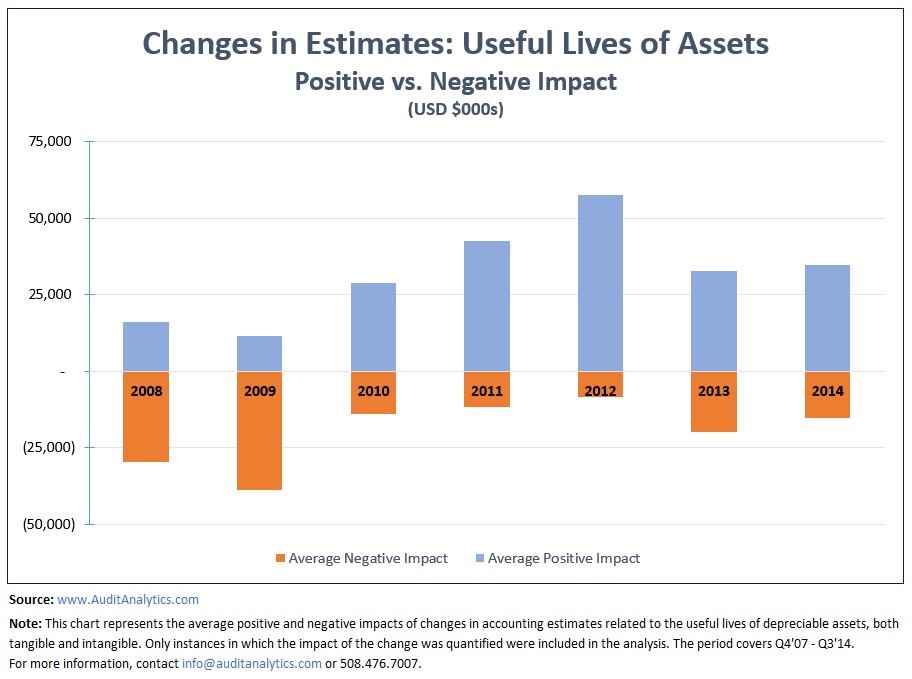

Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics Consider a piece of equipment that costs 25000 with an estimated useful life of 8 years and a 0 salvage value.

| Topic: ABC LTD should account for the change in estimate prospectively by allocating the net carrying amount of the asset over its remaining useful life. Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics When There Is A Change In Estimated Depreciation |

| Content: Learning Guide |

| File Format: PDF |

| File size: 6mb |

| Number of Pages: 23+ pages |

| Publication Date: October 2018 |

| Open Changes In The Useful Lives Of Depreciable Assets Changes In The Useful Lives Of Depreciable Assets Audit Analyticsaudit Analytics |

|

Straight Line Depreciation Accountingcoach The process is pretty simple.

| Topic: Only future years depreciation should be revised. Straight Line Depreciation Accountingcoach When There Is A Change In Estimated Depreciation |

| Content: Answer |

| File Format: Google Sheet |

| File size: 1.5mb |

| Number of Pages: 24+ pages |

| Publication Date: June 2019 |

| Open Straight Line Depreciation Accountingcoach |

|

Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit Depreciation Formula for the Straight Line Method.

| Topic: B current and future years depreciation should be revised. Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit When There Is A Change In Estimated Depreciation |

| Content: Analysis |

| File Format: Google Sheet |

| File size: 1.7mb |

| Number of Pages: 9+ pages |

| Publication Date: April 2017 |

| Open Unit Of Production Depreciation Budgeting Money Managing Your Money The Unit |

|

In straight-line depreciation the expense amount is the same every year over the useful life of the asset. When there is a change in estimated depreciation. Each year the book value changes because some of the value has already been depreciated.

Its really easy to prepare for when there is a change in estimated depreciation When there is a change in estimated depreciation. In straight-line depreciation the expense amount is the same every year over the useful life of the asset. Each year the book value changes because some of the value has already been depreciated. Changes in the useful lives of depreciable assets changes in the useful lives of depreciable assets audit analyticsaudit analytics straight line depreciation accountingcoach units of production depreciation how to calculate formula depreciation methods principlesofaccounting fixed assets depreciation read full article read full info accounts4tutorials 2015 10 fix accounting and finance asset management fixed asset small business accounting checklist an immersive guide abhishek sawant change in accounting estimate examples internal controls disclosure activity based depreciation method formula and how to calculate it accounting hub

0 Comments